2017.11.22. 10:11

The economic role of corporations in Zala county by corporate tax declarations

THE COMPOSITION OF THE CORPORATES IN THE COUNTY

In 2016, 8625 county-based companies with double-entry bookkeeping submitted corporate income tax declaration. The number of enterprises decreased slightly compared to the previous year. The reason for this is that the opportunities offered by a more favourable form of taxation (kata, kiva) are appealing to many taxpayers. The enterprises operating in Zala county account for 2,2% of the companies of the country, which is the same as the rate of the previous year.

Regarding the sectors of national economy, most companies in the county (21,1%) were engaged in the wholesale and retail trade; repair of motor vehicles and motorcycles sector. This was followed by the enterprises engaged in professional, scientific and technical activities, which accounted for 12,6% of the county-based enterprises. On the third place, the enterprises engaged in manufacturing industry can be found with 10,4 % share. The enterprises in construction industry (8,5%) and in real estate industry (7,7%) had similar weights.

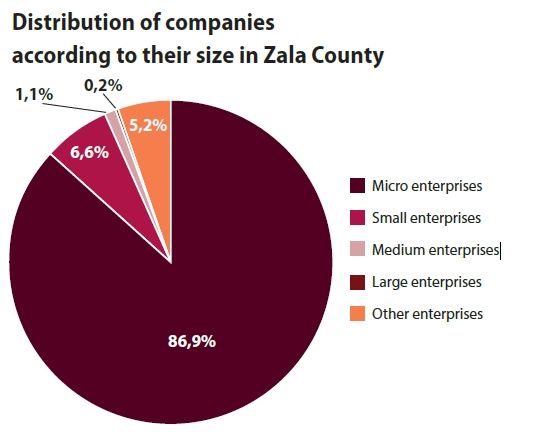

The majority of corporate tax declarations in the county were submitted by micro enterprises with 0 to 9 number of employees, their share was 86,9%. The share of small companies employing 10-49 heads was 6,6%, and the share of medium enterprises employing 50-249 heads was 1,1%. The share of large companies was the smallest; only 17 companies with more than 250 employees were operating in the county. Enterprises in not elsewhere classified other entrepreneurial category (typically foundations engaged in entrepreneurial activities, associations, law firms) represented 5.4% of the total companies.

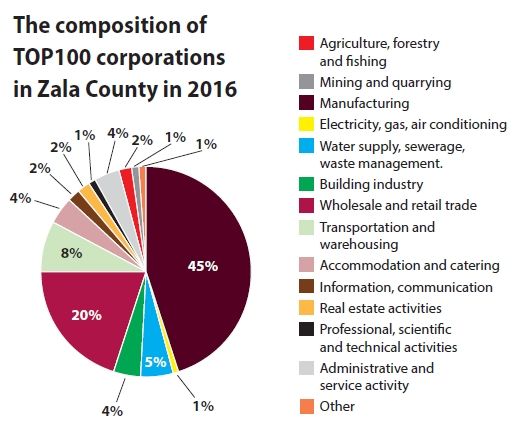

In 2016, most of the 100 most significant enterprises in Zala County – classified by economic sectors – were engaged in the manufacturing sector (43 taxpayers). The following largest sector is trade, which was conducted by 19 companies listed in the TOP100 list. This is followed by transport and storage sector with 8 companies. The companies operating in the field of water supply, sewerage, waste management were represented by 5 enterprises; the companies with accommodation and food service activities, as well as the companies in administrative and service sector were represented by 4 enterprises between the largest ones.

More than half of enterprises in the TOP100 list (55 companies) can be classified as medium enterprise. Large enterprises are represented by 15 taxpayers, while small enterprises are represented by 19 in the list. In addition, 8 micro-enterprises were ranked among the largest.

NET SALES REVENUE

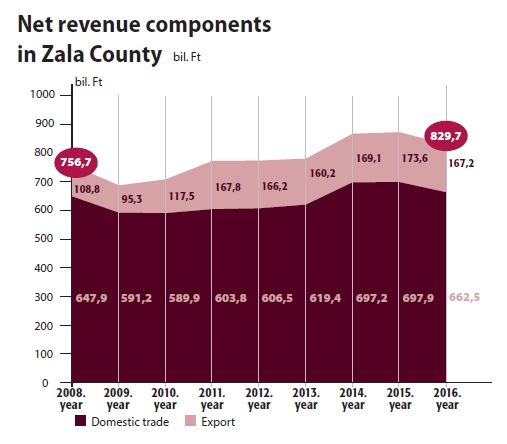

The main indicator of economic performance, the net sales revenue in 2016 was 829,7 billion HUF, which decreased by 4,8 % compared to last year. On a national level, the revenue decreased similarly to the county level (-4,4%), so Zala county – as in the previous years – gave 1,1% of the national amount.

Regarding the performance of the sectors, 31,9 % of the revenue was generated in the manufacturing industry, where a small growth (+0,9%) can be observed. This was followed by the trading industry with 25,6%, where slightly less (-1,1%) revenue was realized. Proportionally, the highest rate of growth (11,6%) could be registered among enterprises engaged in administrative and support service activities, this is followed by performance growth (11,1%) of companies in arts, entertainment and recreation.

The large companies which represent only 0,2% of the companies of Zala County realized 14,0 % of the revenues, which is nearly the same as the previous year. Both the micro, small and medium enterprises contributed to the net sales revenue in a similar part rate (27-29%). Among the 100 enterprises with the largest revenue, the net sales revenue decreased by 3,3% in 2016 compared to previous year. The resulted 390,8 billion HUF gave the 47,1% of the county amount.

Considering the performance of the sectors among the taxpayers of TOP100 the manufacturing industry is determining, where 47,5% of the revenue was realized. This was followed by the enterprises in trade industry with 18,7%. On the third place there is the construction industry sector with 5,9% share. In other sectors, only the transportation sector has a share over 5%, these businesses contributed with 5,2% to the revenue of the 100 largest companies. The other sectors shared the remaining 22,7%.

Nearly half of the net sales revenue (54,9%) was realized by medium enterprises, the large enterprises gave 25,6% of the revenue.

The composition of sales in Zala county is characterized by domestic trade flow, which share is 79,8% and remains significant with a 5,1% decrease. Nearly one third of the domestic trade flow was generated by micro enterprises, but a 3,7% decrease can be observed. The annual export level decreased with 3,7 %, its share of revenues was 20.2% in 2016. More than three-quarters of the cross-border sales were realized in the SME sector, it is almost the same amount of export as the previous year.

Similarly to the county tendency, the composition of sales among the TOP100 companies is also characterized by a high proportion of domestic trade flow. In 2016, this share was 69,4%, with 2,1% export and 3,8% domestic trade flow decrease. More than half of domestic trade flow (53,1%) was generated by medium enterprises, while one quarter was realized by large enterprises. The domestic trade flow of micro and small enterprises (7,2% and 14,0%) accounted for the remaining small proportion. Nearly half of the domestic trade flow of Zala County (40,9%) were given by the TOP100 enterprises in 2016.

CORPORATE TAX

The corporations in 2016 – after accounting the reducing and increasing items of pre-tax profit – stated 51,2 billion HUF positive tax base in their declaration, which is 4,8% less than in the previous year. The tax calculated on the positive tax base was 5,5 billion HUF, which was 1.8% less than the value in 2015. The used tax benefits reduced the tax with 0,5 billion HUF, which gave 83.3% of annual value of 2015.

After taking into account the tax benefits, 4,7 billion HUF corporate financial liability was in the county, which decreased by 0,2 billion HUF (-4,0%) compared to previous year. The TOP100 companies, exceeding the value of the previous year with 7,3%, realized 17,7 billion HUF positive tax base, which contributed to the county amount with 34,6%.

The tax calculated on the positive tax base was 2,1 billion HUF, which is 0,2 billion HUF more (+10,5%) than the 2015 annual value. After taking into account the tax benefits 1,6 billion HUF corporate tax liability arose, which is 6.7% more than the 2015 figure. One third of the tax liability of Zala county were realized by the TOP100 companies.